Creating a formal promissory note is a crucial step in securing a personal loan. It's a legally binding agreement outlining the terms of the loan, including the principal amount, interest rate, repayment schedule, and consequences of default. A well-structured promissory note protects both the lender and the borrower, fostering trust and ensuring a smooth loan process. This article provides a comprehensive guide to creating a free promissory note template, covering essential elements and best practices. Understanding the nuances of this document is vital for anyone seeking to obtain a personal loan. The core of a successful promissory note lies in its clarity, precision, and adherence to legal requirements. Let's delve into the key components and how to craft a template that's both effective and legally sound.

Understanding the Importance of a Promissory Note

Before we dive into the template itself, it's important to grasp why a promissory note is so important. It's more than just a simple agreement; it's a legally recognized document that establishes a clear framework for the loan. It protects both the lender and the borrower by defining the obligations and responsibilities of each party. A poorly drafted note can lead to disputes, delays, and even legal action. A clear and well-executed promissory note minimizes these risks and streamlines the loan process. Furthermore, it provides a documented record of the agreement, which can be invaluable in case of future disputes. The ability to demonstrate adherence to the terms of the note is a significant advantage for both parties.

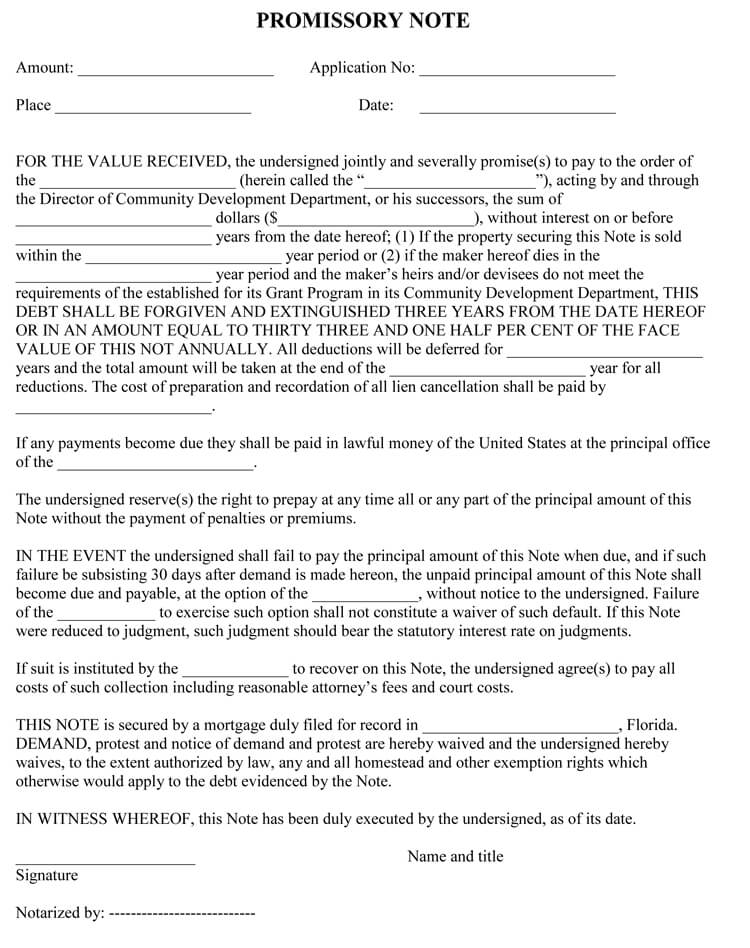

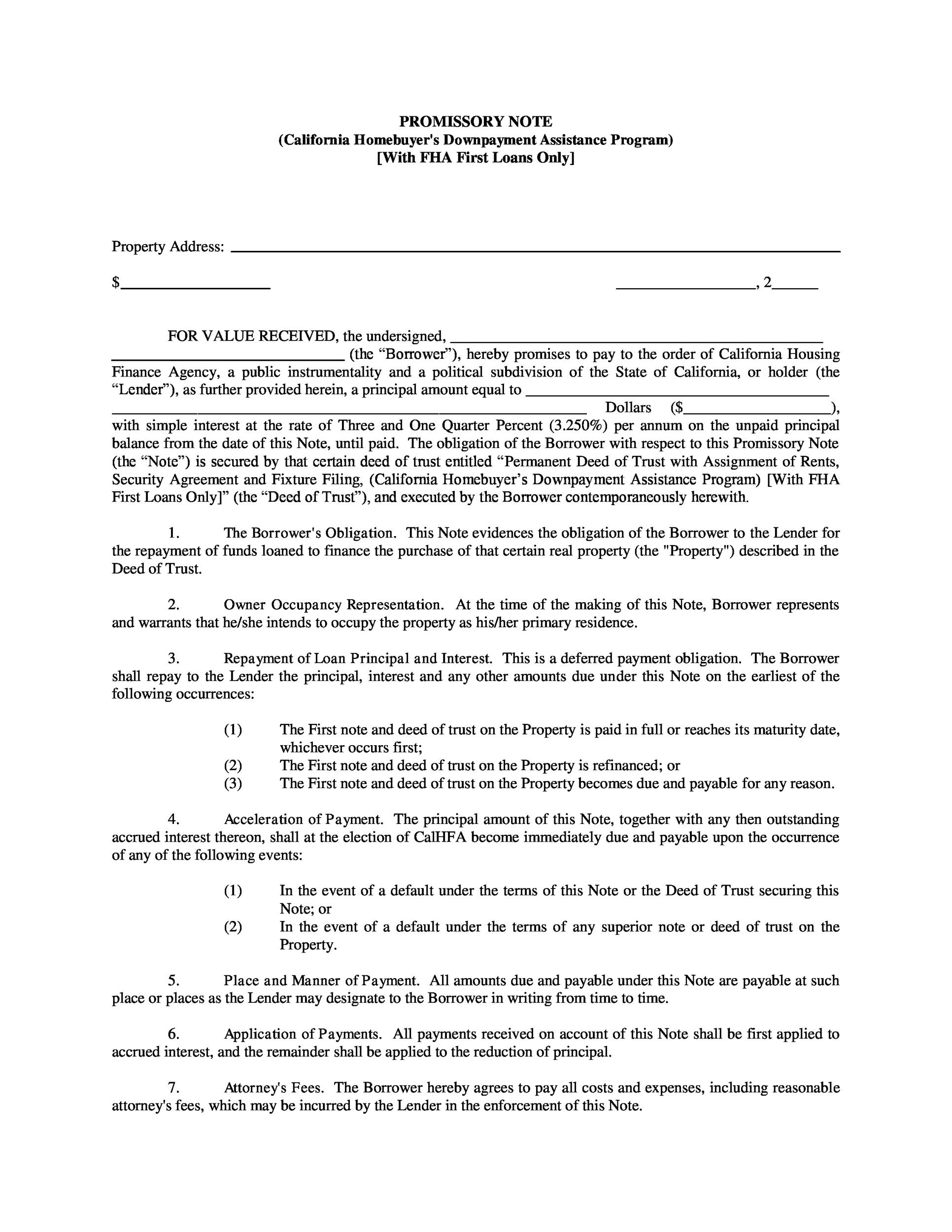

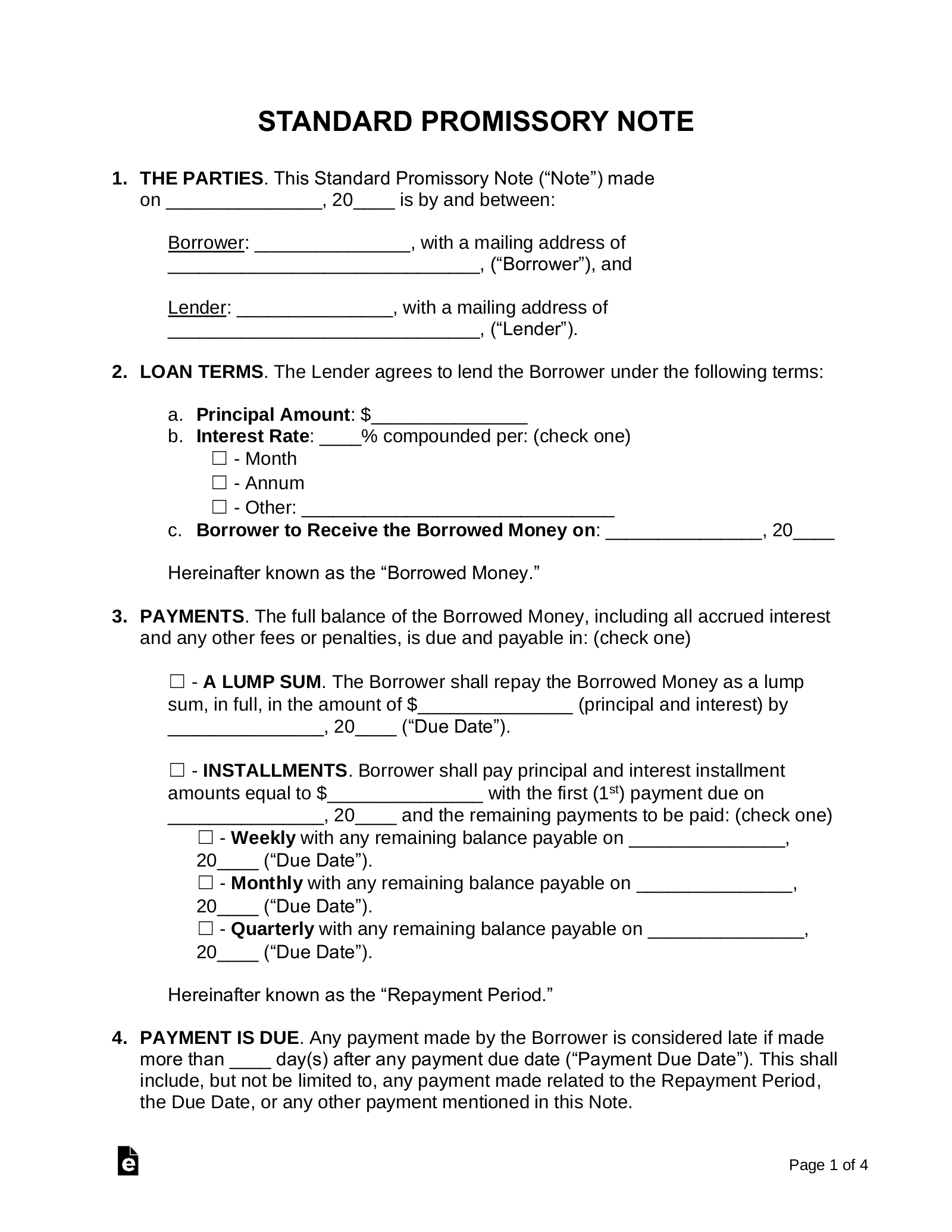

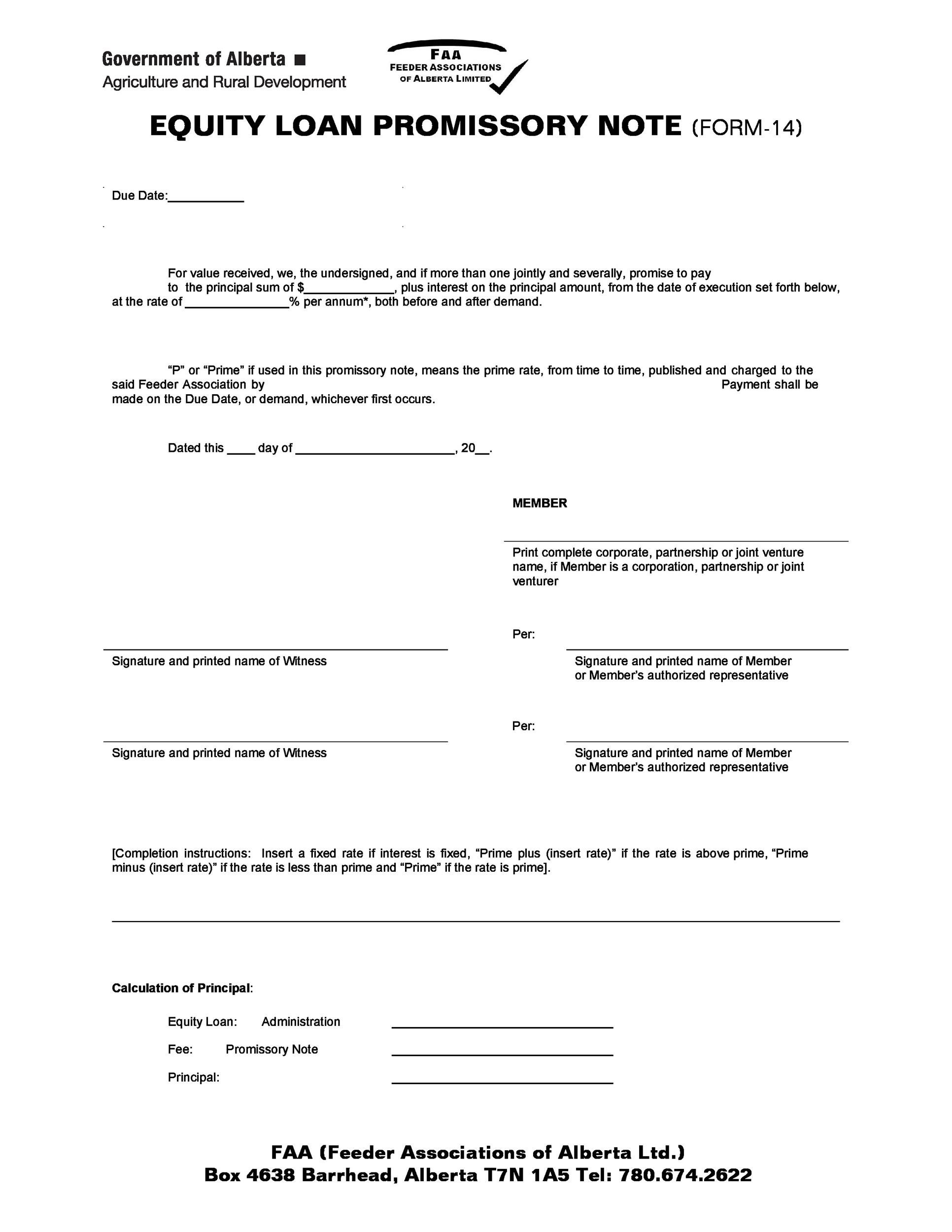

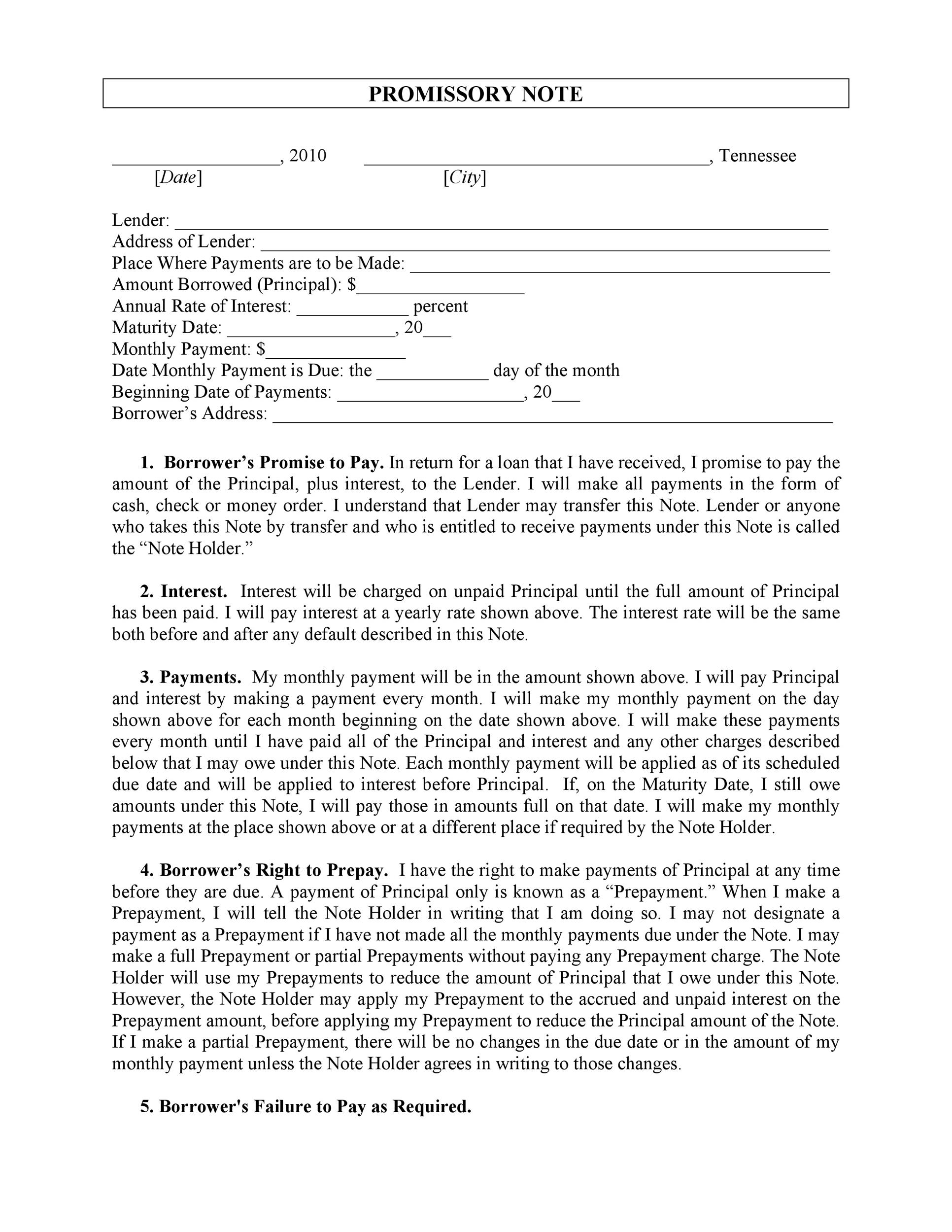

Key Components of a Free Promissory Note Template

A comprehensive free promissory note template should include the following essential elements:

- Loan Information: This section clearly identifies the loan amount, the purpose of the loan, and the loan originator (the lender).

- Borrower Details: The note should include the borrower's full legal name, address, and contact information.

- Lender Details: The lender's name, address, and contact information are also crucial.

- Loan Amount: The precise amount of the loan is stated, including any applicable interest rate.

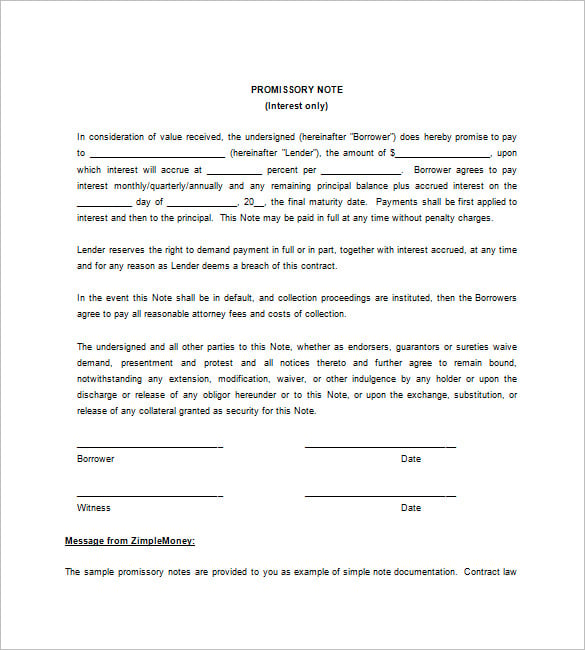

- Interest Rate: The annual interest rate (or the rate applicable to the loan period) must be clearly defined.

- Repayment Schedule: This is arguably the most important section. It specifies the frequency and amount of payments, including the due date for each payment.

- Payment Details: The type of payment (e.g., monthly, quarterly) and the method of payment (e.g., check, electronic transfer) are outlined.

- Default Provisions: This section outlines the consequences of failing to meet repayment obligations. It's vital to clearly state what actions will be taken if the borrower defaults.

- Governing Law: Specifies the jurisdiction whose laws will govern the agreement.

- Signatures: The note must be signed by both the borrower and the lender, signifying their agreement to the terms.

Building Your Free Promissory Note Template

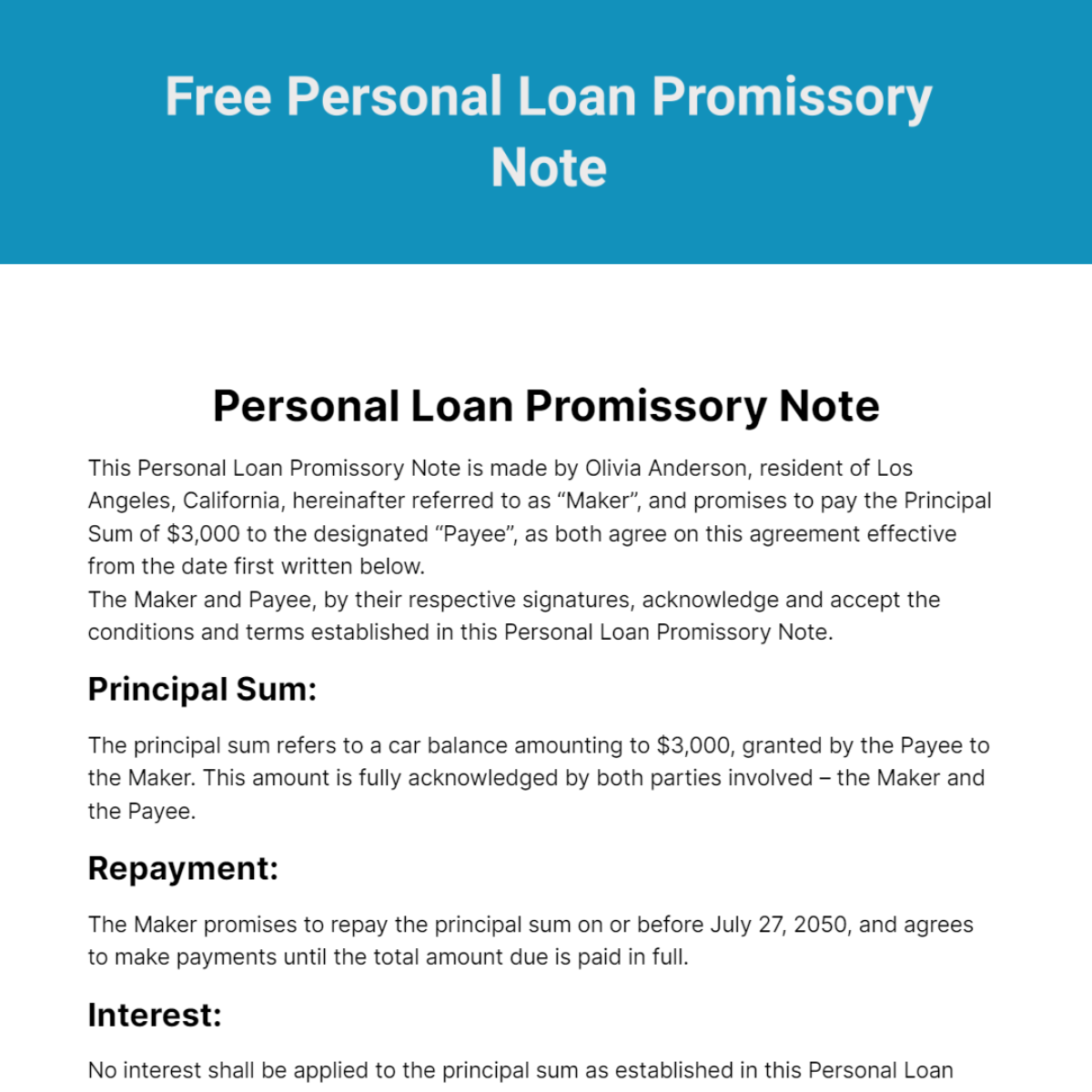

Let's look at a basic structure for a free promissory note template. Remember, this is a starting point – you can customize it to fit your specific needs.

Promissory Note

This Promissory Note is made as of this [Date] by and between [Borrower's Full Legal Name] (hereinafter referred to as "Borrower") and [Lender's Full Legal Name] (hereinafter referred to as "Lender").

1. Loan Information

- Loan Amount: $[Loan Amount] (USD)

- Purpose of Loan: [Clearly state the purpose of the loan – e.g., "to purchase a vehicle," "for educational expenses," etc.]

2. Borrower Details

- Borrower's Full Legal Name: [Borrower's Full Legal Name]

- Borrower's Address: [Borrower's Full Address]

- Borrower's Contact Information: [Phone Number, Email Address]

3. Lender Details

- Lender's Full Legal Name: [Lender's Full Legal Name]

- Lender's Address: [Lender's Full Address]

- Lender's Contact Information: [Phone Number, Email Address]

4. Loan Interest Rate

- Annual Interest Rate: [Interest Rate Percentage] (e.g., 6.5%)

5. Repayment Schedule

- Payment Frequency: Monthly

- Payment Due Date: [Date]

- Payment Amount: $[Amount]

6. Default Provisions

- In the event of default, Lender may pursue legal remedies, including but not limited to, repossession of collateral, seizure of assets, and legal fees.

- Borrower shall promptly notify Lender of any financial hardship that may impact their ability to meet repayment obligations.

- Borrower agrees to maintain insurance coverage as required by the Lender.

7. Governing Law

This Promissory Note shall be governed by and construed in accordance with the laws of [State/Jurisdiction].

8. Signatures

Borrower (Signature) Lender (Signature)

Printed Name Date

The Role of "Free Promissory Note Template For Personal Loan"

The phrase "Free Promissory Note Template For Personal Loan" is strategically placed at the beginning, but it's not essential to the document's core functionality. It serves as a reminder to the reader that this is a readily available resource. However, the focus should remain on the detailed information and the terms of the loan itself. The template provides a foundation, but the borrower's responsibility is to carefully review and adapt it to their specific circumstances.

Legal Considerations and Disclaimer

It is extremely important to consult with a legal professional before entering into any loan agreement. This template is for informational purposes only and does not constitute legal advice. Promissory notes can be complex, and it's crucial to ensure compliance with all applicable laws and regulations. The lender is solely responsible for ensuring the validity and enforceability of the promissory note. This template should be reviewed and modified by a qualified attorney to meet your specific needs and legal requirements. Furthermore, be aware of any state-specific requirements regarding promissory notes.

Conclusion

Creating a robust and legally sound promissory note is a critical step in securing a personal loan. By carefully considering the key components, utilizing a well-structured template, and seeking professional legal guidance, you can protect both yourself and your lender. Remember to prioritize clarity, precision, and adherence to all applicable laws and regulations. A well-drafted promissory note is a valuable tool for managing your finances and establishing a reliable loan agreement. Investing the time and effort to create a professional document will ultimately contribute to a smoother and more secure loan experience.

0 Response to "Free Promissory Note Template For Personal Loan"

Posting Komentar